Saturday, 9 March 2024

Benefits to Pensioners in 12th BP Settlement

Residual issues of Bank Retirees

UNION BANK RETIRED EMPLOYEES' ASSOCIATION

(Registered under Trade Union Act, 1926 : Registration No.G-6201)

(Affiliated to All India Bank Retirees' Federation

through All India Union Bank Retirees' Federation)

403, Sadhana Down Town, Near Punjab National Bank,

Jubilee Chowk, Rajkot - 360 001 (Gujarat). Phone: 0-94272-07021

E-mail < ubiretirees@gmail.com > < rajkot@ubiretirees.in >

======================================================

Date: 9th March, '24

To

All the regular recipients of our Association's e-mails,

Friends,

Residual issues of Bank Retirees

Please see the attachment. It is signed by the Executives of Indian Banks' Association and Principal Office Bearers of the Federations affiliated to UFBU.

As stated therein, undermentioned issues of the Retired Employees will be discussed and finalised within 6 months.

- Updation of Pension (Point No.2)

- Improvement in Pension Scheme (Point No.3)

- Premium of medical Insurance Policy to be borne by the Banks (Point No.8)

- DA scheme to all pensioners to be at the uniform Index of 8088 points (Point No.11)

Yours sincerely,

B.G.Raithatha,

General Secretary

https://drive.google.com/file/d/1BoY1vjRjwbbIZDePtcYUoDQXnBBE94Xw/view?usp=drivesdk

Circular issued by AIUBEA after 12th BP Settlement

UNION BANK RETIRED EMPLOYEES' ASSOCIATION

(Registered under Trade Union Act, 1926 : Registration No.G-6201)

(Affiliated to All India Bank Retirees' Federation

through All India Union Bank Retirees' Federation)

403, Sadhana Down Town, Near Punjab National Bank,

Jubilee Chowk, Rajkot - 360 001 (Gujarat). Phone: 0-94272-07021

E-mail < ubiretirees@gmail.com > < rajkot@ubiretirees.in >

======================================================

Date: 9th March, '24

To

All the regular recipients of our Association's e-mails,

Friends,

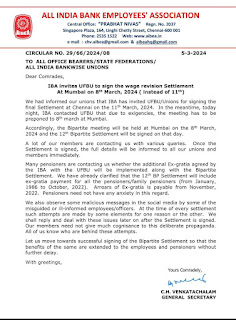

Circular issued by AIUBEA after 12th BP Settlement

The Circular dated 8th March, '24 issued by Comrade N. Shankar, General Secretary, All India Union Bank Employees' Association is attached to this e-mail. Com. Shankar is the Office Bearer of AIBEA.

Yours sincerely,

B.G.Raithatha,

General Secretary

https://drive.google.com/file/d/1BmzLav8gAWrjBmsC95elJT6Xt4JZQzvo/view?usp=drivesdk

Positive à expressed by ALL INDIA BANK PENSIONERS’ & RETIREES’ CONFEDERATION regarding 12th BP Settlement

UNION BANK RETIRED EMPLOYEES' ASSOCIATION

(Registered under Trade Union Act, 1926 : Registration No.G-6201)

(Affiliated to All India Bank Retirees' Federation

through All India Union Bank Retirees' Federation)

403, Sadhana Down Town, Near Punjab National Bank,

Jubilee Chowk, Rajkot - 360 001 (Gujarat). Phone: 0-94272-07021

E-mail < ubiretirees@gmail.com > < rajkot@ubiretirees.in >

======================================================

Date: 9th March, '24

To

All the regular recipients of our Association's e-mails,

Friends,

Positive à expressed by ALL INDIA BANK PENSIONERS' & RETIREES' CONFEDERATION regarding 12th BP Settlement

The Circular dated 8th March, '24 issued by AIBPRC is attached to this e-mail.

B.G.Raithatha,

General Secretary

https://drive.google.com/file/d/1BlH7NlDgH_hh7h2n-MCprMLfH8bobvFG/view?usp=drivesdk

Circular issued by AIBRF regarding benefits to pensioners in 12th BP Settlement

UNION BANK RETIRED EMPLOYEES' ASSOCIATION

. Phone: 0-94272-07021

E-mail < ubiretirees@gmail.com > < rajkot@ubiretirees.in >

======================================================

Date: 8th March, '24

Friends,

Circular issued by AIBRF regarding benefits to pensioners in 12th BP Settlement

The above referred circular is reproduced herewith. As further stated in Para No.3 (f), the Ex-gratia pension will be reviewed annually starting from, April, 2024 presumably to take care of increase in DR during the relevant period.

Yours sincerely,

B.G.Raithatha,

General Secretary,UBREA

(11)

https://drive.google.com/file/d/1BdL4KTmk0tsrowTlO54SZotkgBbK1pKM/view?usp=drivesdk

Benefits to Pensioners in 12th BP Settlement

UNION BANK RETIRED EMPLOYEES' ASSOCIATION

Phone: 0-94272-07021

E-mail < ubiretirees@gmail.com > < rajkot@ubiretirees.in >

======================================================

Date: 8th March, '24

Friends,

Benefits to Pensioners in 12th BP Settlement

We reproduce herewith 3 communications received from AIBEA.

- Attachment No.16 : Salient Features of 12th BP Settlement. Para No.3 pertains to Ex-gratia for Pensioners

- Attachment No.17 : 110 reasons to cheer 12th BP Settlement. Reasons Nos. 99, 101 & 108 are related to retired employees

- Attachment No.15 : Circular dated 8th March, '24 issued by AIBEA

Yours sincerely,

B.G.Raithatha,

General Secretary,UBREA

(16)

https://drive.google.com/file/d/1BNAiOvEL5DgeLYAAFRHZvVYABsombi8g/view?usp=drivesdk

(17)

https://drive.google.com/file/d/1BPnadVkkG2SinsrDBT2Jq44irNFePbwy/view?usp=drivesdk

(15)

https://drive.google.com/file/d/1BPnX-xB9mVnRMANqTFHkstvtRmVotVOB/view?usp=drivesdk

Friday, 8 March 2024

9th Joint Note on Officers’ Wage Revision

(Registered under the Trade Unions Act 1926, Registration No.3427/Delhi) C/o State Bank of India Officers' Association (North-Eastern Circle)

State Bank of India, LHO, Dispur, Guwahati, Assam – 781006

aiboc.sectt@gmail.com ; rupamr.aiboc@gmail.com

Circular No. 2024/06

Date: 08.03.2024

To All Affiliates (Please Circulate)

Dear Comrades,

9th Joint Note on Officers' Wage Revision

We are pleased to announce the successful conclusion of negotiations between the Indian Banks Association' and the All India Bank Officers' Confederation culminating into signing of the 9th Joint Note on 8th March, 2024.

The new wage settlement entails several benefits aimed at enhancing the overall compensation package for our officers. We believe these provisions not only acknowledge the hard work and dedication of our officers but also serve as a means to attract and retain top talent within the banking industry.

The salient features of the wage negotiations i.e. the 9th Joint Note are as under:

- 1.Paving the way for 5-day work week – The Joint Note recognizes all Saturdays as holidays, pending government notification. The revised working hours will be effective after notification by the government.

- 2.Substantial Increase in Salary - The total quantum of wage revision increase (Payslip component) is more than Rs. 8284 crores being the 17% of the cost of Payslip component of establishment expenses of Public Sector Banks.

- 3.The new pay scales have been constructed, after merging Dearness Allowance corresponding to 8088 points and additional load thereon.

- 4.With the applicable load of 3.22% the effective load on the basic pay post-merger of dearness allowance @ 30.38% is 4.20%.

- 5.The long-drawn aspiration of the officers' community for two additional increments for CAIIB (CAIIB Part-II) is achieved.

- 6.Officers who have completed CAIIB (CAIIB Part-II) shall be eligible for two increments w.e.f 01.11.2022.

- 7.Officers shall be eligible for three PQPs instead of two PQPs hitherto. PQP-I -Rs 1370/- , PQP-II Rs 3425/- and PQP III- Rs 5480/-

- 8.The effective load for officers completing CAIIB shall be increased substantially.

- 9.Inter se anomaly on account of additional increment for CAIIB is taken care of.

- 10.Inter se anomaly on account of sanction of PQP has also been taken into account.

- 11.The new scales of pay ranges from Rs. 48480/- to Rs.173860/- covering all the scales from Scale I to VII, with effect from 01.11.2022.

- 12.Reworking of the Dearness allowance formula: The conversion factor on account of merger of Dearness Allowances worked out at 0.0549. Instead of being rounded off to 0.05, it is raised to 0.06 extending benefit to serving and retired officers.

- 13.The index for dearness allowance is shifted from 1960=100 series to 2016=100 series resulting into shifting the conversion factor from 0.06 to 0.99 as per 2016=100 series benefitting the officers with enhanced dearness allowance.

14.The factor of 0.99 as per 2016=100 series is converted to 1.00 improving the dearness allowance further.

- 15.Thus, there will be additional benefit in percentage terms in dearness allowance as per the agreed changes negotiated above.

- 16.The Dearness Allowance shall be payable as 1.00 % of 'pay' per percentage point of Index. The DA in the above manner shall be paid for every variation of rise or fall over 123.03 points in the quarterly average of the All India Consumer Price Index for Industrial Workers Base 2016=100. 0.01% change in DA on 'pay' for change in every second decimal place of CPI 2016 over 123.03 points.

- 17.Dearness Relief on pension in the above manner shall be paid half yearly for every variation of rise or fall over 123.03 points in the quarterly average of the All-India Consumer Price Index for Industrial Workers Base 2016=100.

- 18.Officers in JM Grade Scale I who have moved to scale of pay for MMG Scale II after reaching maximum of the higher scale are presently eligible for five stagnation increments. With effect from 1st November, 2022, these officers shall be eligible for seven stagnation increments with frequency of two years each, of which first two shall be Rs. 2680/- each and next five shall be Rs. 2980/- each.

- 19.Officers in MMG Scale II who have moved to Scale of Pay for MMG Scale III after reaching maximum of higher scale are presently eligible for five stagnation increments. With effect from 1st November, 2022 these officers shall be eligible for seven stagnation increments with frequency of two years each, of Rs.2980/- each.

- 20.Officers in substantive MMG Scale III i.e. those who are recruited in or promoted to MMG Scale III are presently eligible for six stagnation increments after reaching maximum of the scale. With effect from 1st November, 2022, these officers shall be eligible for eight stagnation increments, with frequency of two years each, of which first four shall be Rs. 2980/- each and next four shall be of Rs. 3360/- each.

- 21.Officers in SMG Scale IV are presently eligible for two stagnation increments. With effect from 1st November, 2022, these officers shall be eligible for five stagnation increments after reaching maximum of the scale, with frequency of two years each, of which the first stagnation increment shall be Rs. 3360/- and next four shall be of Rs. 3680/- each.

- 22.Officers in SMG Scale V are presently eligible for one stagnation increment. With effect from 1st November, 2022, these officers shall be eligible for four stagnation increments after reaching maximum of the scale, with frequency of two years each of Rs.4000/- each.

- 23.Officers in TEG Scale VI shall be eligible for three Stagnation Increments after reaching maximum of scale, with frequency of two years each, out of which first two shall be of Rs.4000/- each and the third stagnation shall be of Rs.4340/-.

- 24.Officers in TEG Scale VII shall be eligible for three Stagnation Increments of Rs.4340/- each, with frequency of two years each after reaching maximum of scale.

- 25.Fitment on Promotion - Every Officer on promotion shall be fitted in a higher stage in the new scale of pay with a protection of a minimum differential of one increment in Pay drawn by him/her in the pre-promoted cadre or scale, removing the anomaly in fitment.

- 26.The Special Allowance, as percentage of basic pay, carrying the applicable DA thereon, with effect from 01.11.2022 for JMGS I is 26.50%.

- 27.Disintegration of scales for payment led to higher payment of Special allowance to MMGS II and MMGS III. The Special Allowance, as percentage of basic pay, carrying the applicable DA thereon, with effect from 01.11.2022, for MMGS II and MMGS III is 28.30%.

- 28.The Special Allowance, as percentage of basic pay, carrying the applicable DA thereon, with effect from 01.11.2022 for SMGS IV and SMGS V is 30.50%.

- 29.The Special Allowance, as percentage of basic pay, carrying the applicable DA thereon, with effect from 01.11.2022 for Scale VI and Scale VII is 31.50%

- 30.Fixed Personal Pay has been proportionately increased with applicable DA thereon.

- 31.House Rent allowance has been increased to 8%, 9% and 10% of pay, in respect to the area of posting.

- 32.Capital cost on account of HRA increased to 12%, 13.5% and 15%, respectively.

- 33.The city compensatory allowance (CCA) has been increased to Rs 1900/- per month and Rs 2300/- per month based on place of posting.

- 34.Location Allowance – W.e.f. 01.11.2022 a fixed allowance of Rs.1200 /- p.m. is payable to all Officers posted in areas other than the areas that are eligible for CCA.

- 35.Deputation allowance - An Officer deputed to serve outside the bank to an organization in a different place other than the present place of posting will be paid deputation allowance @ 7.75% of Pay with a maximum of Rs. 7500/- per month

- 36.An Officer deputed to another organization at the same place or to the training establishment not owned by the Bank will be paid deputation allowance @ 4% of Pay with a maximum of Rs.3750/- per month.

- 37.Upon deputation of an Officer to another office / branch within the same municipal limits/ urban agglomeration, in Metro / Major 'A' Class cities where the distance of such deputation is 20 km and more from the parent branch / office, halting allowance shall be payable.

- 38.Hill and Fuel allowance for Places with an altitude of 1000 meters and above but less than 1500 meters will be paid @ 2% of Pay subject to a maximum of Rs. 1450 per month.

- 39.Hill and Fuel allowance for Places with an altitude of 1500 meters and above but less than 3000 meters will be paid @ 2.5% of Pay subject to a maximum of Rs. 1900/- per month

- 40.Hill and Fuel allowance for Places with an altitude of 3000 meters and above will be paid @ 5% of Pay subject to a maximum of Rs. 3750/- per month

- 41.Special area allowance is revised as extended to central government employees.

- 42.Learning allowance has been increased to Rs 850/- per month plus applicable DA thereon.

- 43.Officiating Pay - On and from 01.04.2024, an Officer who is required to officiate in a post in a higher scale for a continuous period of not less than 4 days at a time OR an aggregate of 4 days during a calendar month, shall receive an officiating pay equal to 15% of the Basic pay of the person officiating.

- 44.Officiating pay will be eligible not only for Superannuation benefits, but also for Dearness allowance and House rent allowance.

- 45.Mid Academic Transfer allowance has been increased from Rs 1650/- to Rs 2500 p.m. per child.

- 46.Closing allowance has been increased to Rs 1500 per quarter.

- 47.Halting allowance has been increased by 50% across the board.

- 48.For scale I to Scale III, the halting allowance will range from Rs 1800/- to Rs 2925/- per day.

- 49.For scale IV and V, the halting allowance will range from Rs 2150/- to Rs 3375/- per day.

- 50.For scale VI and Scale VII, the halting allowance will range from Rs 2150/- to Rs 4050/per day.

- 51.Lumpsum compensation on transfer has been increased to Rs 40000 for Scale I to Scale III.

- 52.Lumpsum compensation on transfer has been increased to Rs 50000 for Scale IV and above.

- 53.Upon transfer, either 15 days lodging & boarding charges or 15 days Halting Allowance shall be paid to all officers, from the date of joining at new place.

- 54.On and from 1st November, 2022, reimbursement of medical expenses shall be Rs. 13000/- p.a. for Officers in JMG & MMG (Other than SBI).

- 55.Reimbursement of medical expenses shall be Rs. 15400/- p.a. for Officers in SMG & TEG Scales. (Other than SBI).

- 56.Definition of Family: The income criterion for the term wholly dependent family member has been increased to Rs.18,000/- (improved from 12000/-).

- 57.Physically and mentally challenged children, irrespective of age, shall be construed as dependents even after their marriage, subject to income criteria

- 58.Officers can now have any two of the parents or parents-in-law as dependents. The employee will have the choice to substitute either of the dependents or both once in a calendar year.

- 59.Entitlement distance increased to 5500 kms (one way) for officers in JMG-Scale-I, MMG – Scale II & III. For scale IV and above the same will be for 6500 Km (one way).

- 60.An officer in Junior Management Grade will be entitled to travel by AC 1st class by any train including Premium Trains like Rajdhani/ Shatabdi/ Tejas/ Vande Bharat/ Amrit Bharat, etc. (except luxury trains).

- 61.Reimbursement of fare by premium trains as mentioned above (except luxury trains) shall be allowed to all officers.

- 62.Where an officer has applied for LTC/Leave in advance and has also booked the tickets and the LFC is declined or deferred by the management, the cancellation charges will be reimbursed by the Bank

- 63.Where an officer has applied for LFC/leave as per stipulated time and the same is sanctioned and when advance booking of train tickets is not possible, tickets purchased under Tatkal/Premium tatkal will be reimbursed.

- 64.GST Charges levied on Train Fare shall be over and above the entitlement.

- 65.In view of prevailing dynamic fare system, the cost of train tickets charged on the date of booking will be reimbursed.

- 66.LTC / HTC can be availed independently where both husband and wife are working in the same Bank.

67.Air travel eligibility for travel beyond 500 Kms (reduced from 1000 kms).

- 68.Additional reimbursement under LFC for officers working in areas not connected by train.

- 69.LTC facility shall be allowed for an escort who accompanies an Officer with benchmark disabilities on the journey, subject to certain conditions.

- 70.A provision will be put in place to record the reason for refusal or postponement of leave by the management.

- 71.A single male parent can avail sick leave for the sickness of his child of 8 years and below.

- 72.Employees can avail sick leave for the sickness of their Special Child of 15 years and below for a maximum period of 10 days in a calendar year.

- 73.All Women employees shall be allowed to take one day Sick Leave per month without production of medical certificate.

- 74.In case of employees of the age of 58 years and above, sick leave may be granted towards hospitalization of the spouse at a centre other than the place of work and for a maximum period of 30 days in a calendar year.

- 75.An employee shall be granted sick leave at the rate of one month for each year of service subject to a maximum of 720 days during the entire service.

- 76.In partial modification of Leave Rules, Annexure VI clause 3 of Joint Note dated 11th November, 2020, the following shall be added as Note 3 - "In case of delivery of more than two children in one single delivery, Maternity Leave shall be granted upto 12 months.

- 77.Employees shall be granted Bereavement Leave on the demise of the family members (spouse, children, parents and parent-in-law) and number of days of such leave shall be decided by each Bank at their level.

- 78.Officers who are Defence Representatives in departmental enquiries will be granted one day special leave for preparing defence submissions, subject to maximum 10 such leaves.

- 79.Maternity Leave shall be granted once to a female employee for a maximum period of 9 months, for legally adopting a child who is below one year of age, all other conditions remaining the same.

- 80.Maternity Leave may be granted for In vitro fertility (IVF) treatment subject to production of medical certificate, within the overall limit of 12 months.

- 81.Four Half Day Casual Leaves have been introduced for all employees.

- 82.A total of two days of Casual leave may be availed for half a day on 4 occasions in a year out of which 2 occasions would be in the morning and 2 occasions in the afternoon.

- 83.Casual Leave under the above category can be availed after applying 24 hours in advance.

- 84.Special maternity leave upto 60 days shall be granted in case of still born or death of the infant within 28 days of birth.

- 85.Accumulated privilege leave may be encashed upto 255 days at the time of retirement/upon death of an employee while in service.

- 86.Leave Bank Scheme - A staff welfare scheme under which provision would be made for voluntary encashment of Privilege Leave by the employees and the monetized value of such leave would be pooled under a Leave Bank system, out of which, special leave would be sanctioned to the employees affected by contingencies who have exhausted all their leaves.

- 87.All the Banks to evolve and implement a scheme for periodical health checkup of all employees wherever it is not available.

- 88.All employees shall be allowed reimbursement of Rs. 500 per year towards annual eye check-up

- 89.A Committee will be formed to review other provisions of NPS in line with Central Government employees viz. regarding the Choice of Fund Schemes and Fund Managers.

90. An additional amount will be paid as Ex-Gratia per month to all Pensioners.

- 91.Monthly ex-gratia amount shall be paid in addition to the pension/family pension paid by the public sector Banks including SBI, to pensioners and family pensioners, who became eligible to draw pension on or before 31st October, 2022 including those who retired on 31.10.2022.

- 92.Such fixed monthly ex-gratia shall be payable for the month of November, 2022 and onwards during the period 01-11-2022 to 31-10-2027.

- 93.It has been agreed and already extended the benefit of 100% DA neutralisation for PreNovember 2002 pensioners.

- 94.DA rates will be on uniform basis of 100% neutralisation as in the case of employees/ officers/ pensioners/ family pensioners.

- 95.Disciplinary & Appeal Regulations and procedure thereof - Comprehensive Guidelines on Discipline & Appeal Regulations will be brought out after mutual discussion within 3 months from the signing of this joint Note.

- 96.Special compensatory provisions in respect of State Bank of India for certain benefits as mentioned in the joint note, will be reviewed and settled at bank level.

- 97.LTC Monetisation Scheme covering air fare on the lines of some other Banks in the Industry, will be evolved for all Banks after further deliberations.

Comrades, these are some benefits listed herein. The Joint Note addressed many anomalies with respect to salaries, fitments across the scales, aiming to restore the dignity of officers.

Any achievements or the benefits in the joint note are not only attributable to present negotiations but is also a testament of years of hard work and struggles of AIBOC and its members. We congratulate and thank all our affiliates, past and present leaders, all state units, the AIBOC secretariat team and all the members for having unflinching trust in AIBOC, and for staying united, disciplined and resolute during this entire wage revision exercise. We, thus, dedicate all the achievements of this Joint Note to our dedicated members across the fraternity.

There are certain issues which could not be taken to a logical conclusion in the current exercise till the signing of the joint note, and which have been minutised as residual issues with IBA. These will be further discussed and deliberated upon, for them to become a reality in the days to come.

AIBOC is always determined to achieve the maximum benefits for its members, and we will continue to strive for more. This Joint Note surely heralds a new chapter in our journey, promising a future replete with opportunities for growth, wellbeing, and professional fulfilment. Let us embrace these changes with open arms and continue to strive for excellence in all our endeavours.

More challenges await us as we move forward, yet we are confident that our collective efforts would always lead us to right path.

Our Unity Zindabad!

Comradely yours,

Rupam Roy General Secretary

12th BPS of Banks signed today

NON DEDUCTION OF MEDICLAIM PREMIUM

Cabinet approves additional instalment of Dearness Allowance and Dearness Relief to Central Government employees and pensioners

Ministry of Finance

07 MAR 2024 7:57PM by PIB Delhi

The Union Cabinet chaired by Prime Minister Shri Narendra Modi approved to release an additional instalment of Dearness Allowance (DA) to Central Government employees and Dearness Relief (DR) to pensioners w.e.f. 1.1.2024 representing an increase of 4% over the existing rate of 46% of the Basic Pay/Pension, to compensate against price rise.

The combined impact on the exchequer on account of both Dearness Allowance and Dearness Relief would be Rs.12,868.72 crore per annum. This will benefit about 49.18 lakh Central Government employees and 67.95 lakh pensioners.

This increase is in accordance with the accepted formula, which is based on the recommendations of the 7th Central Pay Commission.

***

DS/SKS

Our Representation to Secty(Financial Services)

Dear Sirs,

As known to us, Shri A V Tyagi ji has been making efforts to seek an appointment with the Secretary (Financial Services). However, because of his busy schedule, personal meeting could not be possible. Shri Tyagi ji was in regular contact of the PS of the Secy (Financial Services) and other officials of DFS and was suggested that a reminder may be sent to the Secy (Financial Services). Accordingly, he visited DFS today and submitted our letter on behalf of the Joint Front. He could also meet the Under Secretary Shri Vinod Kumar ji and the Jt Secy (Financial Inclusion) Dr. Prashant Kumar Goyal who is looking after Insurance wing also as additional charge. Shri Tyagi could get the opportunity of discussing all the issues one by one. A communication received from Shri Tyagi ji is given below for favour of information.

"Warm greetings.

Today I visited the DFS and met to Shri Vinod Kumar ji US and with him had the opportunity to to meet Dr Prashant Kumar Goyal IAS JS of Financial Inclusion (FI)to whom additional charge of Insurance assigned . Discussed All major points

- -1Updation of pension

- -2Additional Pension on attaining age 80

- -3Full pension for 7 yrs or on completion of age 67 yrs of the deceased pensioners

- -4Basic Pension on average emoluments or last drawn basic pay which ever is beneficial of Employees

- 5- Ex gratia payment to Pensioners who retired earlier.

- -6To consider Apprenticeship period of Dev officers to be added in service period of confirmed Dev officer

- -7to consider payment of terminal benefits all Dos who terminated under Service rules whereas they have no charge of cheating/ forgery/ misconduct etc under section 37 of staff regulations.

- -8wage revision of employees

After submitting our petition to Goyal sahab we discussed all points . Wage revision draft of employees reached in DFS and they make up their mind to allow increase of 17% in the wages.

and it may clear in couple of days. There are some rumours that FM may announce in press conference along with banks revision tomorrow or day after but chances are less.

On my repeated request on items number 2 , 3,4 they may consider if LIC Management will send the request draft to DFS which still not available in DFS.

Item number 5 ex gratia they agreed and it may get clearance.

The issue of Anomalies they are agreed to send lic for consideration.

Items number 7 and 8 they considered as genuine and if lic will referred hopefully may get through.

The main point of Updation not possible along with wage revision but may consider if LIC Management will refer to DFS.

I don't visit DFS with the aim of discussions but only to submit our petition on behalf Joint Forum Of LIC Pensioners but circumstances provided the opportunity and it happened.

I submitted the petition to FMO too.

The atmosphere is tense .

For information please.

With warm regards. A V Tyagi"