Changes in I-T returns' e-versions irk taxpayers

By Lubna Kably, TNN | Updated: Aug 11, 2018, 08.59 PM

How to file ITRHIGHLIGHTS

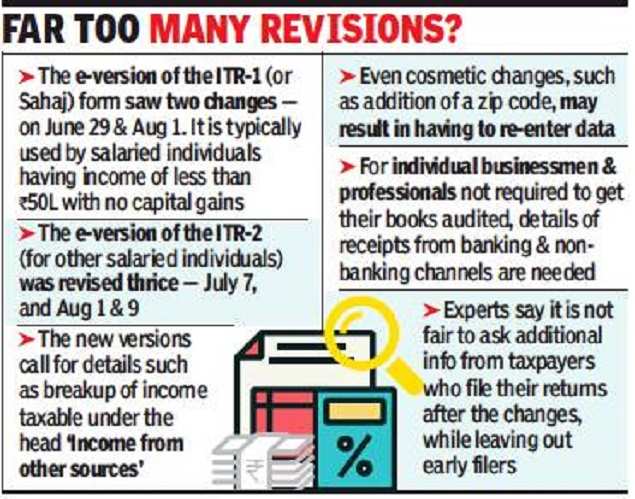

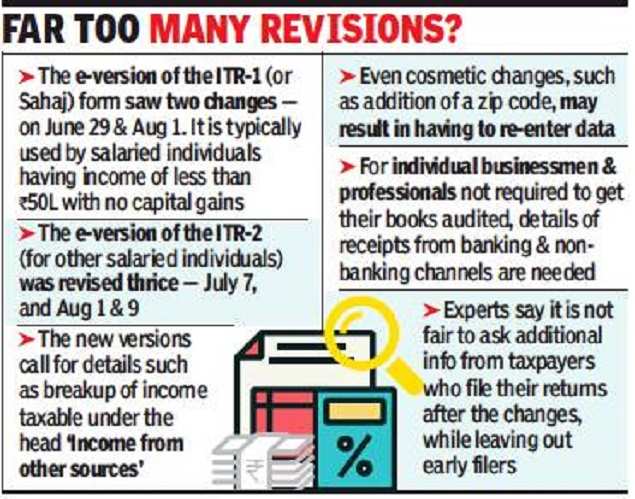

- With less than a month left to file the returns, frequent changes are proving to be irksome

- In some instances, fresh clarifications have to be sought by taxpayers from their chartered accountants

- The changes result in having to re-enter data, or gather more details at the last minute

MUMBAI: Salaried taxpayers who were recently trying to file their income tax returns found another set of changes made to the electronic version (technically also referred to as schema or utility), as released by the I-T department. With less than a month left to file the returns, these frequent changes are proving to be irksome. The changes result in having to re-enter data, or gather more details at the last minute.

In some instances, fresh clarifications have to be sought by taxpayers from their chartered accountants. The due date for filing of I-T returns for salaried taxpayers is July 31, which for the financial year 2017-18 (year ended March 31, 2018) was extended to August end. To illustrate, electronic versions of ITR-1 and ITR-2 — the forms typically used by salaried employees — were revised again as recently as on August 1 and August 9 respectively.

The latest changes in both the forms require additional information in respect of income taxable under the head 'Income from other sources'. It requires the taxpayer to show interest from bank savings accounts, term deposits, interest on refund of income tax and other interest, separately. As an example, 'other interest' could constitute what has been received from company bonds or debentures.

All ITR forms, including those used by corporate entities, such as ITR-7, have seen several 'release changes', in some cases on as many as four instances since the date of notification of the I-T returns on April 5.

Delhi-based chartered accountant Rajeev Khandelwal says, "This is how the I-T department makes changes surreptitiously. It does not change the notified forms but makes changes in the electronic version and, since e-filing is mandatory in most cases, taxpayers or their professionals have to make last-minute changes to the work already done. It is also not fair to ask additional information from some taxpayers who file their returns after such changes were carried out, whereas the same information is not obtained from early filers."

Khandelwal adds, "Taxpayers would readily have details of interest from bank accounts, but many were not reporting the interest on I-T refunds, largely owing to ignorance. While interest on I-T refunds is taxable, several taxpayers are now seeking clarifications from professionals."

Chartered accountant Hinesh R Doshi says, "Further, many taxpayers generate their returns through thirdparty return-filing software. Any changes made in the version released by the I-T department is also required to be incorporated in the third-party software, which takes a few days."

Doshi adds, "In short, such frequent changes lead to hardship in the form of additional compliance, re-entering of data and may also delay the filing of return of income. This is unfair, especially as the I-T Act now contains a penalty for late filing of the I-T returns, which can be a maximum of Rs 10,000." Some changes in these forms are cosmetic in nature, such as addition of a zip code field and some tweaks as regards the address field.

However, these cosmetic changes also result in problems. CNK & Associates tax partner Gautam Nayak explains, "The difficulty is that, very often, you fill up the utility (electronic version) after compiling all the details, and then suddenly realise that the format of the utility has changed. If you try to file the return in the old utility, you would get an error message while uploading the return. You again have to fill up a fresh utility, and if in the meanwhile there is no change once again in the utility, only then can you e-file your return."

I-T regulations require that all returns are to be filed electronically, with a few exceptions carved out for individuals over 80 years of age, or those having annual income of less than Rs 5 lakh.

In some instances, fresh clarifications have to be sought by taxpayers from their chartered accountants. The due date for filing of I-T returns for salaried taxpayers is July 31, which for the financial year 2017-18 (year ended March 31, 2018) was extended to August end. To illustrate, electronic versions of ITR-1 and ITR-2 — the forms typically used by salaried employees — were revised again as recently as on August 1 and August 9 respectively.

ADVERTISEMENT

The latest changes in both the forms require additional information in respect of income taxable under the head 'Income from other sources'. It requires the taxpayer to show interest from bank savings accounts, term deposits, interest on refund of income tax and other interest, separately. As an example, 'other interest' could constitute what has been received from company bonds or debentures.

All ITR forms, including those used by corporate entities, such as ITR-7, have seen several 'release changes', in some cases on as many as four instances since the date of notification of the I-T returns on April 5.

ADVERTISEMENT

Delhi-based chartered accountant Rajeev Khandelwal says, "This is how the I-T department makes changes surreptitiously. It does not change the notified forms but makes changes in the electronic version and, since e-filing is mandatory in most cases, taxpayers or their professionals have to make last-minute changes to the work already done. It is also not fair to ask additional information from some taxpayers who file their returns after such changes were carried out, whereas the same information is not obtained from early filers."

Khandelwal adds, "Taxpayers would readily have details of interest from bank accounts, but many were not reporting the interest on I-T refunds, largely owing to ignorance. While interest on I-T refunds is taxable, several taxpayers are now seeking clarifications from professionals."

ADVERTISEMENT

Chartered accountant Hinesh R Doshi says, "Further, many taxpayers generate their returns through thirdparty return-filing software. Any changes made in the version released by the I-T department is also required to be incorporated in the third-party software, which takes a few days."

Doshi adds, "In short, such frequent changes lead to hardship in the form of additional compliance, re-entering of data and may also delay the filing of return of income. This is unfair, especially as the I-T Act now contains a penalty for late filing of the I-T returns, which can be a maximum of Rs 10,000." Some changes in these forms are cosmetic in nature, such as addition of a zip code field and some tweaks as regards the address field.

However, these cosmetic changes also result in problems. CNK & Associates tax partner Gautam Nayak explains, "The difficulty is that, very often, you fill up the utility (electronic version) after compiling all the details, and then suddenly realise that the format of the utility has changed. If you try to file the return in the old utility, you would get an error message while uploading the return. You again have to fill up a fresh utility, and if in the meanwhile there is no change once again in the utility, only then can you e-file your return."

I-T regulations require that all returns are to be filed electronically, with a few exceptions carved out for individuals over 80 years of age, or those having annual income of less than Rs 5 lakh.

(This article was originally published in The Times of India)

No comments:

Post a Comment